The smart Trick of Feie Calculator That Nobody is Talking About

Wiki Article

The 4-Minute Rule for Feie Calculator

Table of ContentsThe Facts About Feie Calculator UncoveredAn Unbiased View of Feie CalculatorThe Of Feie CalculatorWhat Does Feie Calculator Do?The Ultimate Guide To Feie Calculator

He marketed his U.S. home to develop his intent to live abroad completely and used for a Mexican residency visa with his other half to assist fulfill the Bona Fide Residency Test. Neil aims out that getting home abroad can be challenging without very first experiencing the place."We'll absolutely be outside of that. Also if we come back to the United States for physician's appointments or organization calls, I doubt we'll invest more than thirty day in the US in any type of given 12-month duration." Neil stresses the value of strict monitoring of united state sees (Form 2555). "It's something that people need to be truly diligent about," he states, and advises expats to be careful of usual mistakes, such as overstaying in the U.S.

Indicators on Feie Calculator You Should Know

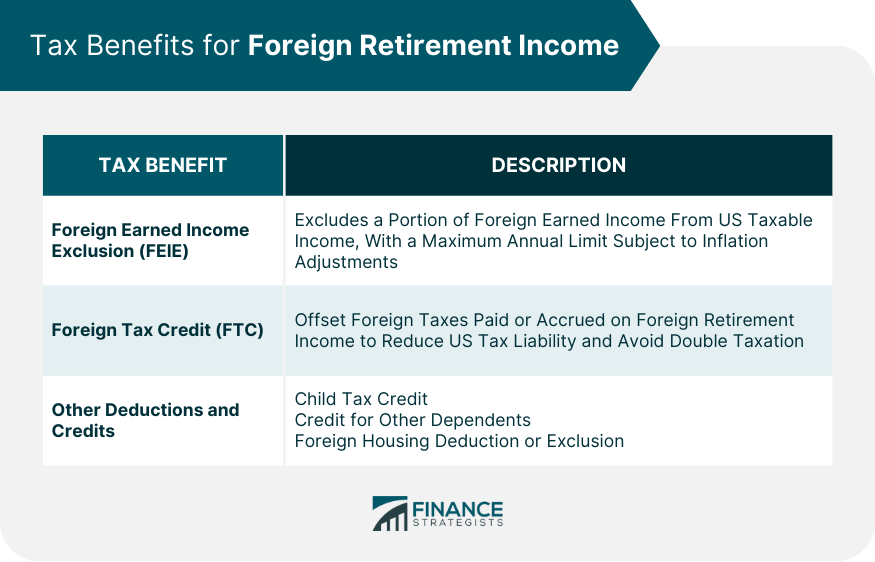

tax obligation obligations. "The reason that united state taxation on worldwide income is such a big deal is due to the fact that many individuals forget they're still subject to united state tax obligation also after transferring." The united state is just one of minority countries that taxes its citizens despite where they live, indicating that also if a deportee has no earnings from U.S.tax return. "The Foreign Tax obligation Credit rating allows individuals functioning in high-tax countries like the UK to offset their united state tax obligation obligation by the amount they have actually currently paid in taxes abroad," says Lewis. This guarantees that expats are not exhausted twice on the same revenue. Nonetheless, those in reduced- or no-tax nations, such as the UAE or Singapore, face extra difficulties.

The 9-Minute Rule for Feie Calculator

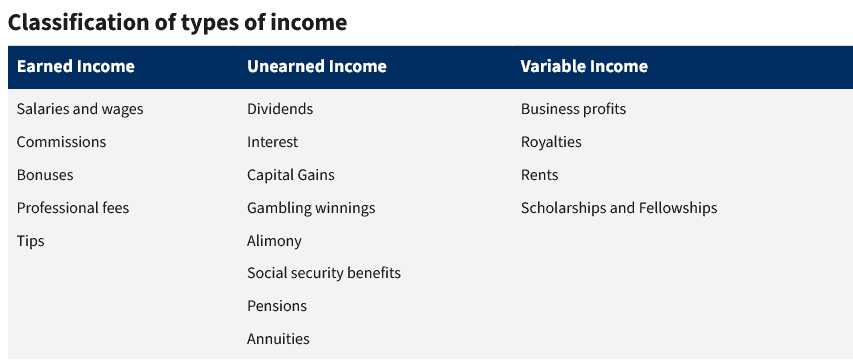

Below are some of the most often asked inquiries about the FEIE and other exclusions The International Earned Revenue Exemption (FEIE) allows U.S. taxpayers to exclude as much as $130,000 of foreign-earned revenue from government earnings tax, lowering their U.S. tax obligation. To get approved for FEIE, you have to meet either the Physical Visibility Examination (330 days abroad) or the Authentic House Examination (prove your primary residence in a foreign country for an entire tax year).

The Physical Existence Test also requires U.S (Foreign Earned Income Exclusion). taxpayers to have both a foreign revenue and an international tax home.

Excitement About Feie Calculator

An income tax treaty in between the united state and one more nation can assist prevent dual taxation. While the Foreign Earned Revenue Exclusion lowers taxable revenue, a treaty might offer fringe benefits for eligible taxpayers abroad. FBAR (Foreign Financial Institution Account Report) is a called for declare united state citizens with over $10,000 in international economic accounts.Qualification for FEIE depends on meeting particular residency or physical existence tests. He has over thirty years of experience and currently specializes in CFO services, equity compensation, copyright taxes, marijuana taxation and separation relevant tax/financial preparation issues. He is an expat based in Mexico.

The foreign made earnings exclusions, in some cases referred to as the Sec. try this site 911 exemptions, omit tax on salaries earned from functioning abroad. The exclusions make up 2 components - a revenue exemption and a real estate exclusion. The following FAQs talk about the advantage of the exclusions consisting of when both partners are expats in a basic fashion.

Examine This Report about Feie Calculator

The tax advantage leaves out the revenue from tax obligation at lower tax obligation prices. Formerly, the exclusions "came off the top" lowering revenue topic to tax obligation at the leading tax obligation rates.These exemptions do not spare the incomes from US taxation but just give a tax obligation decrease. Note that a bachelor functioning abroad for every one of 2025 that made concerning $145,000 without various other revenue will certainly have gross income decreased to absolutely no - properly the very same response as being "tax totally free." The exclusions are computed each day.

Report this wiki page